Take the reins on payments with PayTo

Whether you're setting up recurring bills, memberships or subscriptions, paying one-off bills, or shopping online, PayTo gives you the power to securely authorise and manage payments from your bank account.

PayTo is here:

When it comes to your money, visibility and control is everything. With PayTo, you can see, review and authorise all new PayTo payments for things such as recurring bills, memberships and subscriptions before the money leaves your account. You can also pause and cancel your PayTo agreements at any time. That means no nasty surprises when payments are deducted.

What is PayTo?

PayTo is a new, secure payment option that gives you more visibility and control over payments from your account.

- View, authorise, cancel or pause your PayTo payments in Internet Banking or the Bank of Melbourne App.

- Easily keep track of recurring bills and ongoing payments like subscriptions and memberships.

- Make payments direct from your eligible account knowing your payment details will only be stored in a secure independent system.

It was developed by New Payments Platform Australia (NPPA), a wholly owned subsidiary of Australian Payments Plus, Australia’s domestic payment organisation that also includes BPAY® Group and eftpos.

You’ll start seeing PayTo as an option for all kinds of payments, so keep an eye out for it.

Why use PayTo?

Security

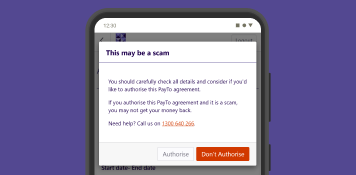

All new PayTo agreements need to be authorised by you in Internet Banking or the Bank of Melbourne App before a business can take a payment.

Simplicity

It's easy to set up PayTo with either your PayID or eligible BSB and account number.

Visibility

You can see all your PayTo agreements in one place and know when payments are due to come out of your account.

Flexibility

It's easy to switch the Bank of Melbourne accounts linked to your PayTo agreements, or to pause or cancel agreements at any time.

How PayTo works

Watch the following video, or read the steps below to see how easily you can set up and use PayTo.

Look for the PayTo symbol when you're setting up recurring bills, memberships or subscriptions, or paying one-off bills, or shopping online.

Enter your PayID or eligible BSB and account number.

Review and authorise your new PayTo agreement on your phone or desktop.

Congratulations! You can now view, pause or cancel your PayTo agreements at any time in Internet Banking or the Bank of Melbourne App.

FAQs

Personal accounts:

- Complete Freedom

- Concession Account

- Retirement Access Plus

The following business accounts are eligible to make PayTo payments when held by an individual (sole trader):

- Freedom Business Account

- Business Cheque Account Plus

- Business Access Saver

- Business Statutory Trust Account (e.g., Solicitors, Real Estate, Other)

- Society Cheque Account (Business)

- GST Provision

- Commercial Money Market

- Standby Account

- Standard Business Cheque Account

- Commercial Line of Credit

- Business Umbrella Investment Loan Account

- Business Maximiser

- Commercial Overdraft

- Other Trust Account

- Business Maximiser Account

Important information

Read the PayTo Terms and Conditions (PDF 149KB) and the Bank of Melbourne Internet and Phone Banking Terms and Conditions and Important Information (PDF 375KB) before making a decision and consider whether the product or service is right for you. Online Banking is subject to outages from time to time.

BPAY is ® Registered to BPAY Pty Ltd ABN 69 079 137 518.