Let repayments take care of themselves.

Just set up Autopay on your Bank of Melbourne credit card.

Heard about Autopay?

It’s a helpful way to make sure your credit card is repaid on time, every month – and once it’s set up, you don’t have to lift a finger. Because you’ve probably already got enough things to remember!

How Autopay helps

Get started in three easy steps

Mobile Banking

- Logon to Mobile Banking and select “Card Autopay” from the Service menu.

- Select the eligible Bank of Melbourne account that you’d like your Autopay repayments to come from.

- Choose whether you want to make minimum repayments, or pay off your closing balance in full each month. And that’s it – you’re good to go!

Internet Banking

- Logon to Internet Banking, click “Manage my Accounts”, and select “Card Autopay” from the Card Services menu.

- Select the eligible Bank of Melbourne account that you’d like your Autopay repayments to come from.

- Choose whether you want to make minimum repayments, or pay off your closing balance in full each month. And that’s it – you’re good to go!

Don’t have Internet or Mobile Banking?

You can register online in just a few minutes. Or if you’d prefer, we can help you set up Autopay in person. Just download an Automatic Payment Plan form (PDF 677KB), fill it in, and bring it to your nearest Bank of Melbourne branch.

FAQs

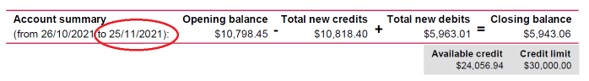

Your Autopay repayments will start on your current payment due date if your Autopay has been set up before 11pm AEST/AEDT on the “to date” shown in the “Account Summary” section on your current statement. If it has been set up after this date, then you will need to continue to make a manual payment until you receive your next credit card statement. See screen shot below to find where the “to date” is shown on your statement.

Things you should know:

1. Subject to the Bank of Melbourne Credit Card Terms and Conditions (PDF 268KB).

2. Bank of Melbourne Internet Banking registration required. Refer to the Internet Banking Terms and Conditions.