Slice up your credit card bill with Plan&Pay.

A clever new instalment plan option on your Bank of Melbourne credit card.

Why Plan&Pay?

Make a plan to pay off purchases, your balance or both

Pay off a purchase

Bought a new fridge, bike or holiday with your credit card and want to pay it off over time? With Plan&Pay, you can convert big purchases into smaller set instalments2 – and the savings can really add up.

- Use on any purchase over $200 that you’ve made on your credit card within the last 30 days.

- Pay it back over 3, 6 or 12 months.

- 0% p.a. interest. Just pay an upfront fee based on a percentage of the purchase amount on your chosen plan (1% for 3 months, 2% for 6 months or 4% for 12 months). 1

More to love

You can cancel your Plan&Pay at any time (or pay it off sooner) without any extra fees. The standard variable rate of interest will apply to any remaining balance.

How to get started

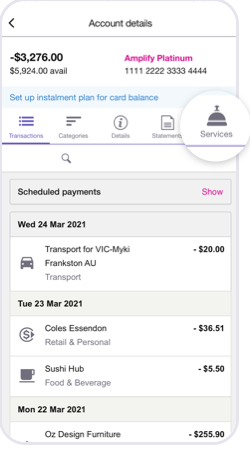

1. Select Plan&Pay

Click the ‘Services’ bell on your credit card Account details page, then select ‘Plan&Pay instalment plans’.

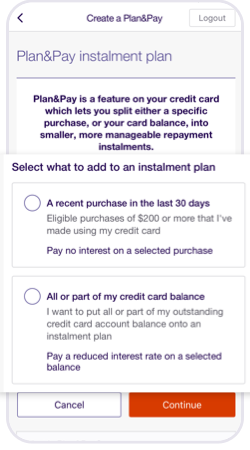

2. Make a plan

Choose to set up a Plan&Pay plan for any recent eligible purchase, or to pay off your balance.

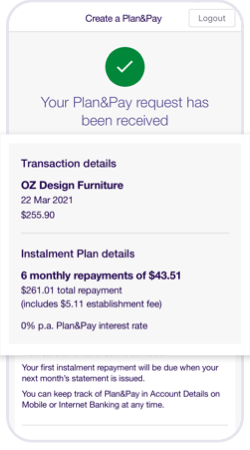

3. Confirm the details

Fill out the remaining information, choose your repayment schedule, then hit confirm to finish.

Some common Plan&Pay questions answered

Simply logon to Internet Banking or the Bank of Melbourne Mobile Banking app to set up and manage a Plan&Pay Instalment Plan. To create a Balance Plan&Pay, choose either a credit card balance, or a Balance Transfer balance with 3 or more calendar months remaining on the balance transfer period. You also have the option of choosing a Cash Advance Balance.

To create a Purchase Plan&Pay, simply view your recent transactions. Any purchase of $200 or more made within the last 30 days will have the option to‘Pay off in instalments’ at 0% p.a. interest. An upfront fee will also apply.1

Things you should know:

1. 0% interest rate applies to Purchase Plan&Pay only. The establishment fee payable varies depending on the instalment plan term plan selected and will be added to your account balance. If you’re close to your credit limit, check this fee won’t take you overlimit.

2. Subject to the Bank of Melbourne Credit Card Terms and Conditions (PDF 268KB).

3. Balance Plan&Pay plans have different interest rates. Logon to your Internet or Mobile Banking to compare Balance Plan&Pay rates against your standard rates.

This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. Read the Credit Card Terms and Conditions before deciding. Unless otherwise specified, the products and services described on this website are available only in Australia from © Bank of Melbourne - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.