Understanding your Home and Contents Insurance cover

Important notice

Here’s a summary of key features of Bank of Melbourne Home and Contents Insurance, provided by Allianz. It doesn’t provide a complete statement of the cover offered, exclusions, conditions and limits that may apply. You should read the Product Disclosure Statement for more details on what’s covered and what may not be covered.

Product Disclosure Statement (PDF 995KB)Product Disclosure Statement (PDF 995KB)

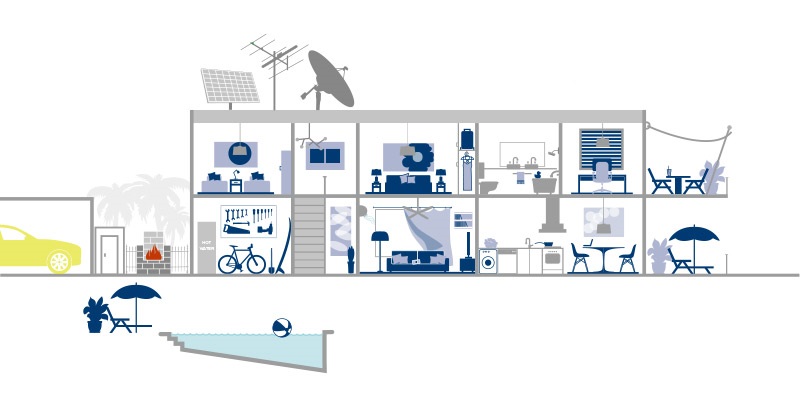

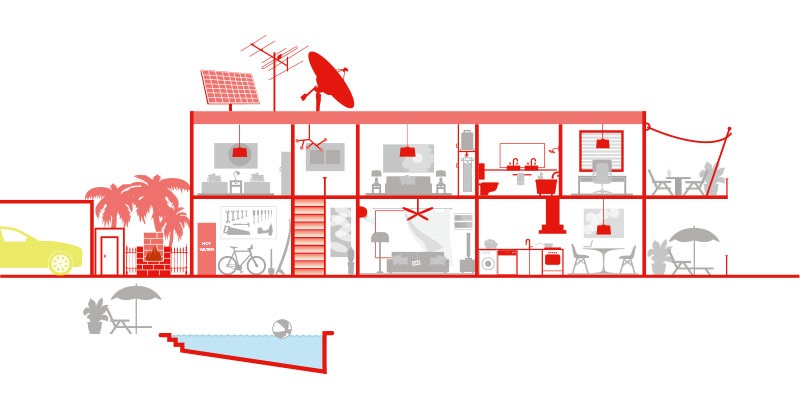

What’s covered?

Building insurance is designed to cover the physical structures and fixtures that make up your buildings. This includes the house, garage, fences and paved driveways – even built-in appliances such as hot water systems, air-conditioners and more.

Refer to page 24 of the Product Disclosure Statement (PDS) (PDF 995KB)Refer to page 24 of the Product Disclosure Statement (PDS) (PDF 995KB)

![]() Covered by Building insurance

Covered by Building insurance

![]() Covered by Contents insurance

Covered by Contents insurance

What you are covered for under each of the insured events

There may be exclusion periods and conditions for each event. Please refer to the relevant page in the Product Disclosure Statement.

Buildings and/or contents

Loss or damage caused by:

- fire

- bushfires and grassfires, or

- smoke.

Additional benefits

Here’s a summary of included additional benefits. These benefits are added to your sum insured amount or are explained below. For full details of what is covered and limitations, please refer to the relevant page in the Product Disclosure Statement.

Buildings

If your home building is damaged by an insured event during the period of insurance to such an extent that you can’t live in it, rental costs for accommodation for you and your pets will be paid for the period it reasonably takes, to repair or rebuild your home building.

Contents

If your contents are damaged by an insured event during the period of insurance to such an extent that you can’t live in your home buildings, a benefit will be paid to help you pay for alternative accommodation.

Optional Cover (at an extra cost)

Here’s a summary of the optional cover you can choose to add to buildings or contents insurance, for an additional fee.

Available for Contents cover, or both Buildings and Contents cover.

Portable contents are items designed to leave your insured address with you (such as a handbag, wallet, suitcase or musical instrument) or on you (such as spectacles, sunglasses, jewellery or clothing).

Choose from two types of portable contents cover (or choose both)

- Unlisted portable contents

Choose from the available limits of cover per item and with a combined total sum insured for all items per claim for unlisted portable contents, without having to individually list these items. - Listed portable contents

You can ask to cover specific portable contents separately for their full value. These items will be covered individually for a specified amount (less any excess).

Note: Laptops, tablets, mobile phones, smart watches and other wearable technology are only covered under this option if they are specified on your policy as Listed Portable Contents. Cracked glass or screens are not covered where this is the only damage to the item.

What may not be covered

You may not be covered for damage caused by, or to, items that have not been well maintained. For example, if a storm causes water damage to your ceiling, you may not be fully covered if the water entered because of a poorly maintained roof.

There are some general and additional exclusions that apply to certain insured events. For full details of what may be excluded, please refer to the relevant page in the Product Disclosure Statement.

Including depreciation, gradual deterioration, wear and tear or lack of maintenance.

The Detail

There are some general and additional exclusions that apply specifically to certain insured events. For full details, please refer to the Product Disclosure Statement.

*A 72-hour exclusion period applies to some insured events. Allianz does not provide cover (where the type of cover you have under the policy provides it) for any loss of or damage to property caused by cyclone, flood, grassfires and bushfires, during the first 72 hours after you first take out or increase the cover under the policy. There are some general exclusions and additional exclusions that apply specifically to certain insured events. Make sure you check these carefully by reading the Product Disclosure Statement.

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. The information is not advice, recommendation or opinion on any products or services provided by Bank of Melbourne or third parties. For this reason, you should consider the appropriateness for the information to your own circumstances and, if necessary, seek appropriate professional advice. For more information on any specific products or services distributed or provided by Bank of Melbourne, you may wish to read the relevant Product Disclosure Statement. To see some of the events covered and not covered, please refer to our Key Fact Sheets (KFS).

Home and Contents Insurance is issued by Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz). Bank of Melbourne - a Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (the Bank) arranges the initial issue of the insurance under a distribution agreement with Allianz Insurance, but does not guarantee the insurance. This information does not take into account your personal circumstances. Before making a decision, please consider the relevant Product Disclosure Statement. For more information call 1800 825 866.

If you take out Home and Contents Insurance with Allianz the Bank will receive a commission of up to 12% of the premium (exclusive of GST).

A target market determination has been made for this product. Please visit https://www.bankofmelbourne.com.au/tmd for the target market determination.

By selecting 'Get a quote' you will enter a third party site hosted by Allianz. Any personal information you provide to Allianz’s hosted site will be collected, used and disclosed in accordance with Allianz’s Privacy Statement and Privacy Policy.

Bank of Melbourne's Privacy Statement is available at bankofmelbourne.com.au/privacy/privacy-statement or by calling 13 22 66. It covers:

- How you can access the personal information Bank of Melbourne holds about you and ask for it to be corrected;

- How you can complain about a breach of the Privacy Act 1988 (Cth) or a registered Code by Bank of Melbourne and how Bank of Melbourne will deal with your complaint; and

- How Bank of Melbourne collect, hold, use and disclose your personal information in more detail.